How cost competitive are BC’s Mass Timber projects?

Digital Climate podcast with Scius’s Helen Goodland

August 8, 2021

Introducing BC’s Construction Cleantech Ecosystem

September 17, 2021As BC’s construction innovation advisory firm, we at Scius keep a keen eye on key industry trends.

Over the last few years, we have been tracking the uptake of mass timber in BC and across Canada. As of September 2021, we have identified 350 projects in BC that have used some form of engineered timber structure that incorporated CLT, NLT, DLT, glulam and/or advanced prefabricated panel systems.

Our data includes projects completed between 2007 and September 2021 – everything from single family homes to high rises. The smallest building is 220sf, the largest is over 500,000sf.

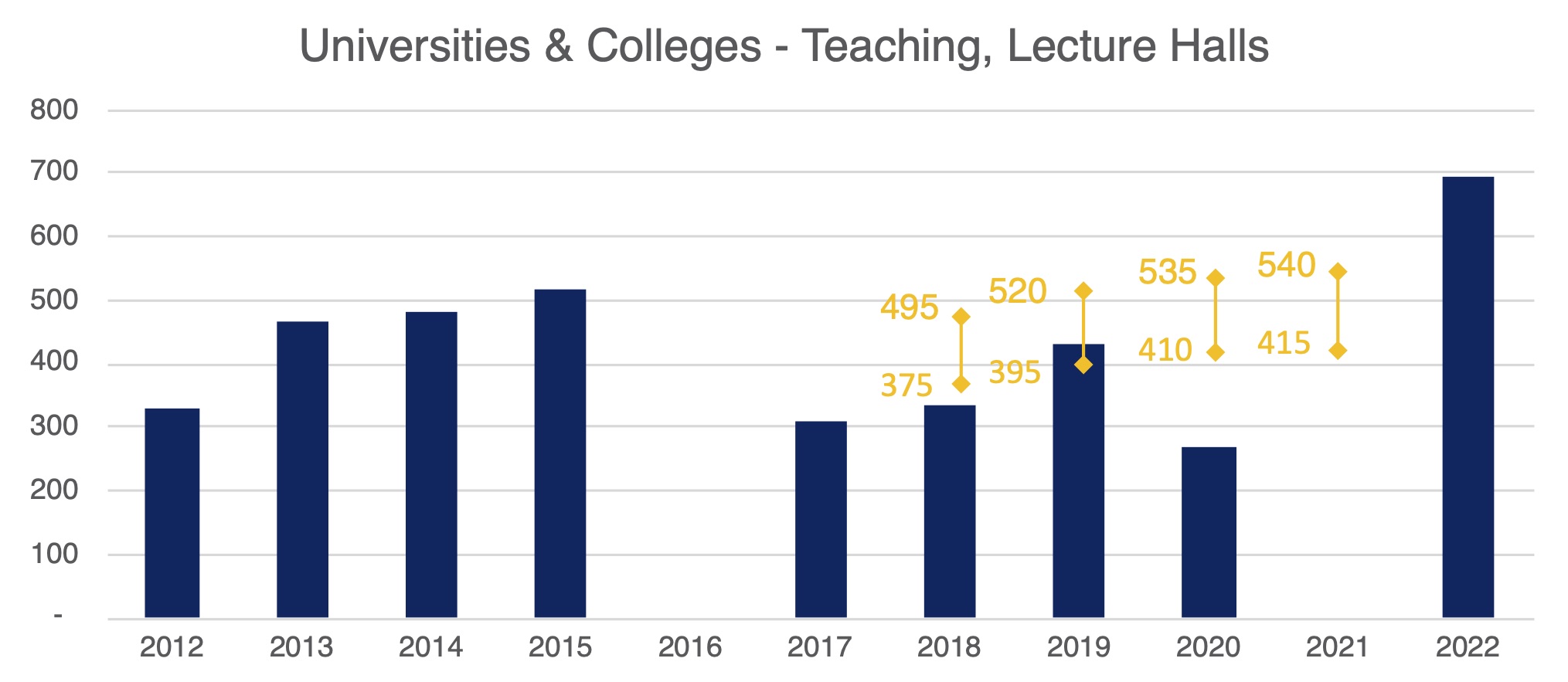

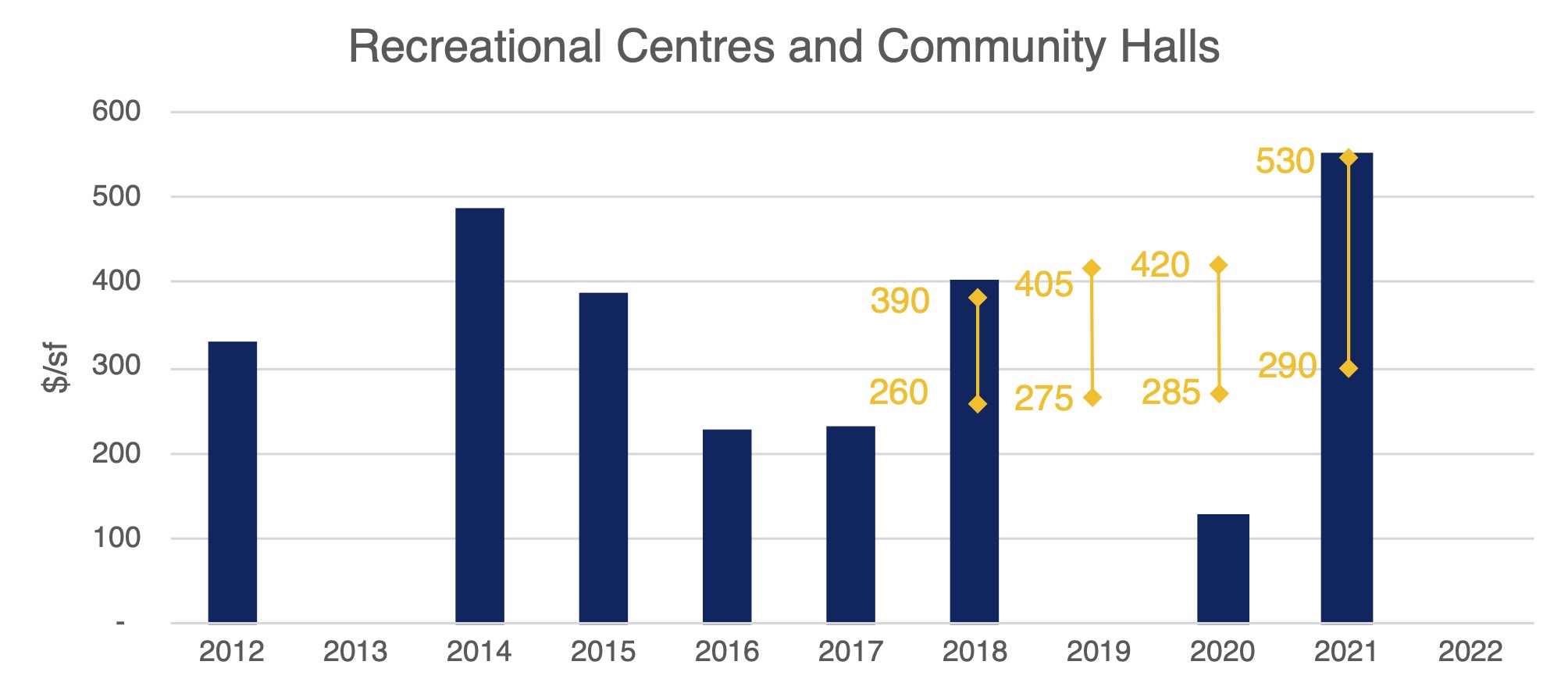

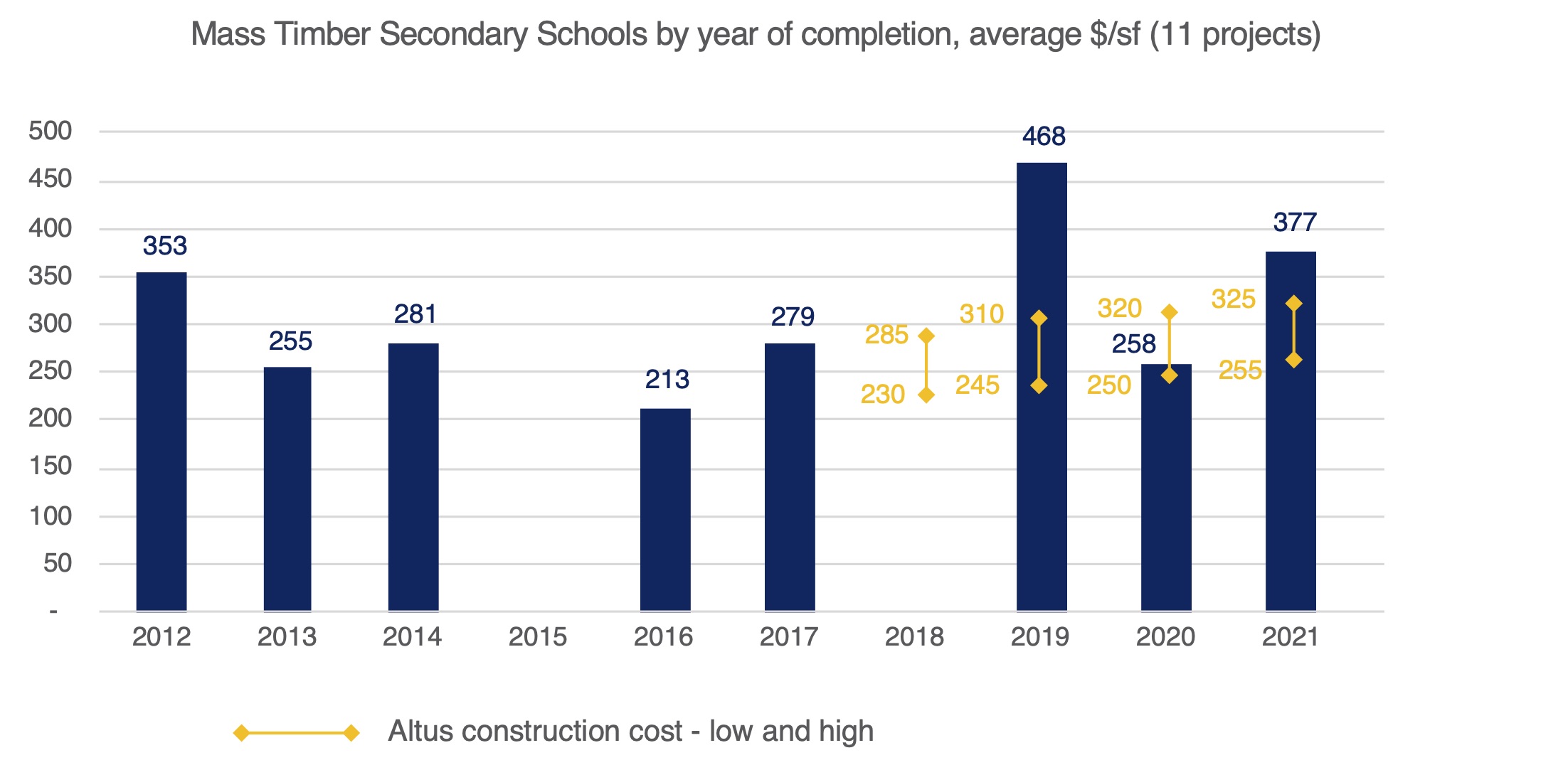

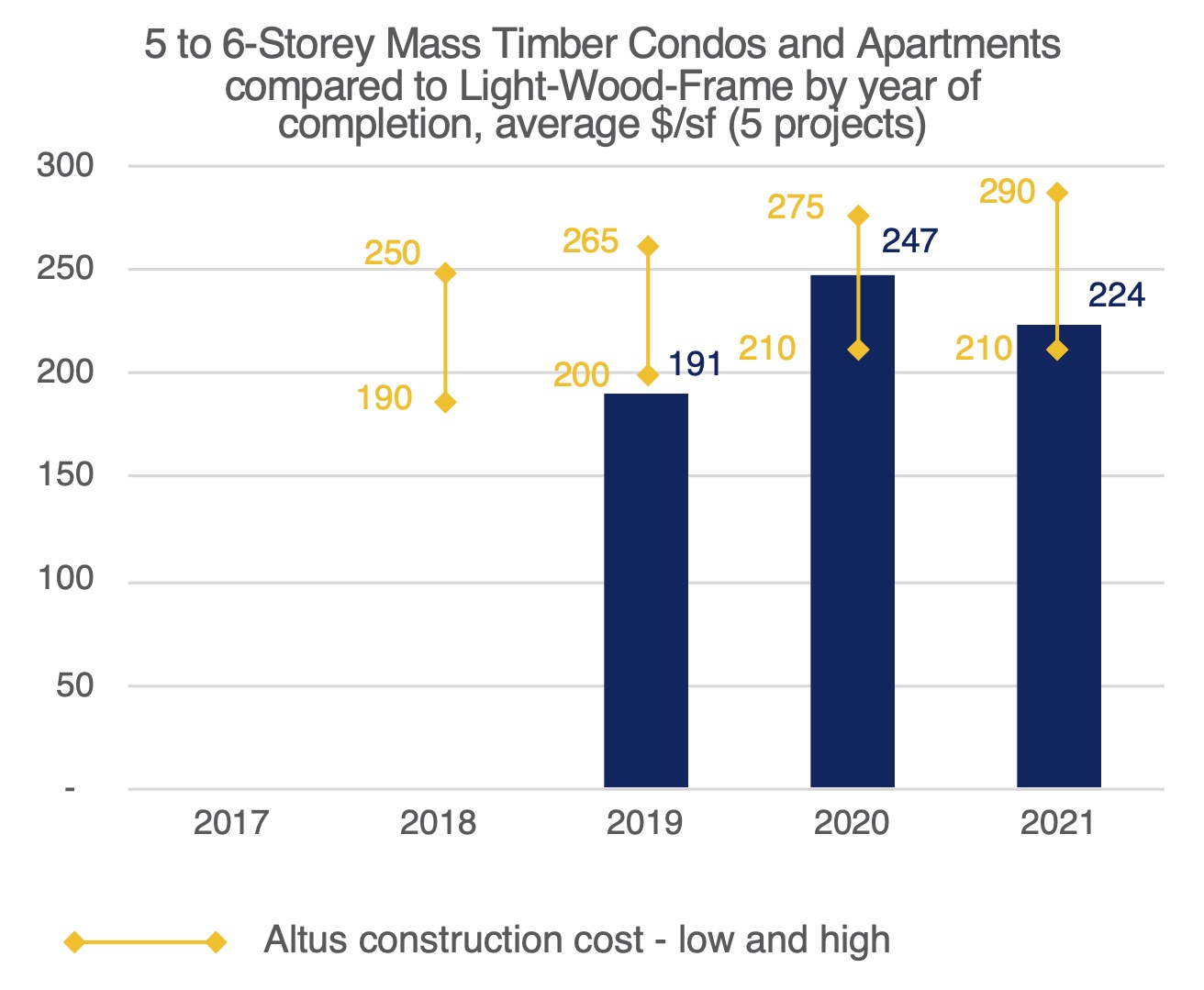

Of these, 144 have publicly available information about cost (via project team websites, funding announcements, case studies, social media, permit approvals, etc.). Here’s how a few of the key building typologies stack up against Altus Group’s Canadian Construction Cost Guide (2018 – 2021).

For institutional buildings, we present data on community centres, university buildings, secondary schools – categories where we have cost data for at least 10 mass timber projects. We also have cost data for 5 mass timber 5-6 storey condo buildings, which we have compared against Altus’s prices for 5-6 storey light wood frame. In fact, we have cost data for over thirty different types/uses of mass timber building in BC but for most, the sample sizes are less than 5 projects.

What these charts show is that mass timber projects appear to be competing favourably against conventional projects on a $/sf basis. However, there are plenty of caveats.

Arguably, the sample (less than 150 projects) is small. It is likely that the mass timber project cost data is subject to positive bias. Data for successful projects is much easier to come by than for those that had problems. Most of the cost data for the mass timber projects is budget-based. Only a very few projects publish the price as completed.

Up until 2018, there were some struggles with CLT supply and there was a certain amount of cost volatility – which is why we only compare project costs with Altus’s data from 2018 onwards. More recently, we are still riding out the impacts of COVID and it is probably too early to say what impacts (if any) the latest spike in lumber prices may have had.

Some regional variation is also to be expected. There are mass timber projects located right across the province. The furthest north is outside of Fort Nelson. Altus’s data is for Metro Vancouver, and it tends to be more expensive to build elsewhere (except in the Southern Interior). For illustration, Altus provided the following regional cost comparison factors in their 2018 guide (none included in the 2021 guide).

Vancouver 100

Victoria 108

Whistler 115

Southern Interior 95

Northern Interior 115

This is the first time we have lined up the costs of mass timber projects against an industry accepted cost guide. We offer this information as a pulse check and welcome more input from project teams on how their projects compare. All our data is aggregated and anonymized. When it comes to cost information, we do not name names – no matter how brilliantly the project has performed.

What we hope is that these largely positive results give designers and builders the confidence to share the details of their mass timber project’s accomplishments as this, in turn, will encourage owners and developers to invest in mass timber in the future.